Trading Bot for a Hedge Fund

Real-time order book analysis system with under 200ms latency for a hedge fund trading team.

Real-time order book analysis system with under 200ms latency for a hedge fund trading team.

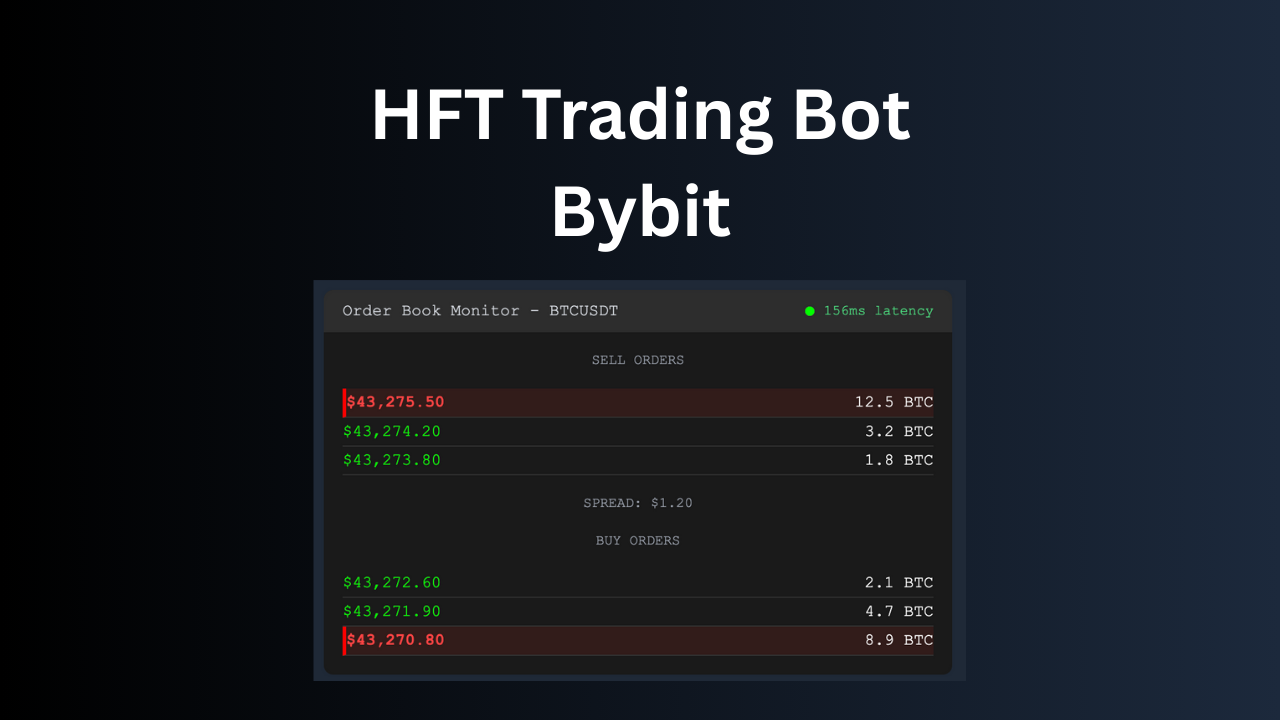

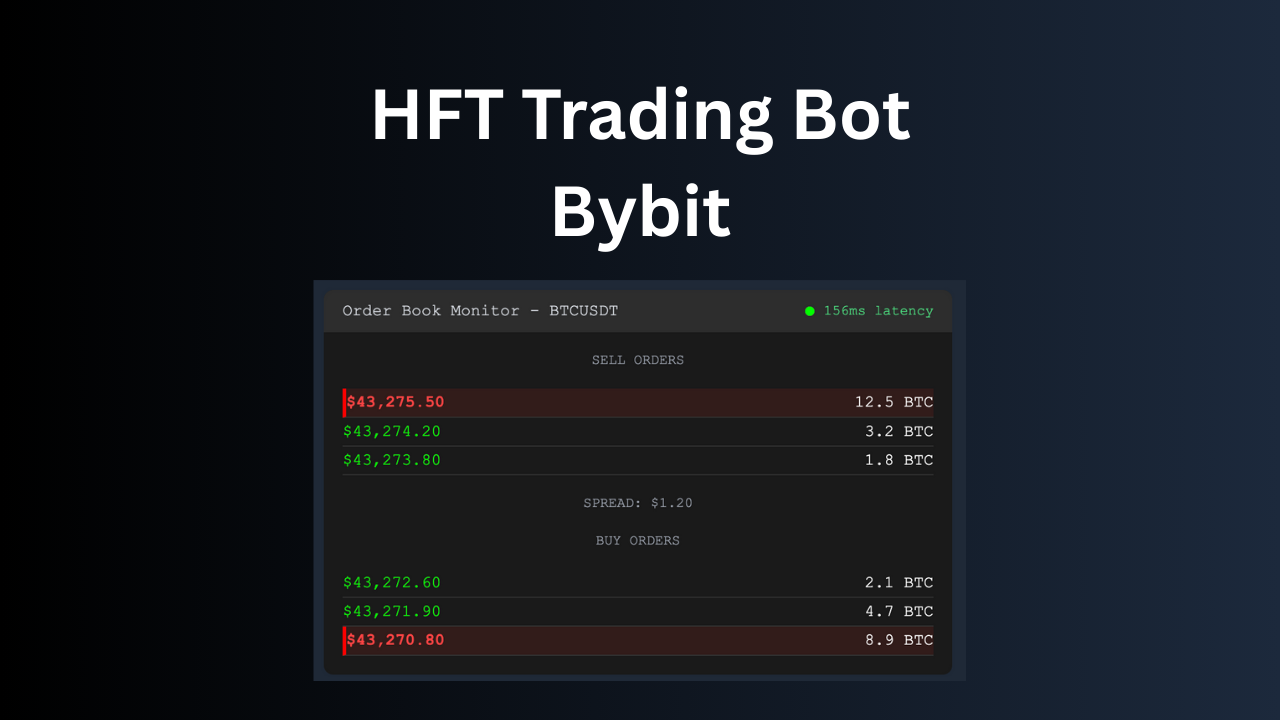

A trading bot designed for a hedge fund's trading team. The main goal was to analyze the order book for large orders in real time.

It was extremely important to keep latency as low as possible (under 200ms) so that the strategy remains effective. The system ensures stable performance under heavy load and instant processing of market data.

I designed the system to process massive amounts of updates quickly: built asynchronous processing of data from Bybit’s WebSocket API. Removed all unnecessary parsing steps to keep latency below 200ms. Implemented algorithms that immediately detect large orders and send signals to the trading engine.

To handle high load, I split the processing across several threads and added message queues to ensure nothing gets lost. Also stress-tested and profiled the system to guarantee stable performance even at thousands of updates per second.

The system operates reliably under heavy load and handles thousands of updates per second without failures.

Traders use it in live operations: the strategy reacts to large orders instantly, helping them make faster decisions and capture opportunities even in fast-moving markets. This significantly boosts trading efficiency and reduces missed-profit risks.

Interface screenshots.

Write to me on Telegram or submit a request through the form on the main page.