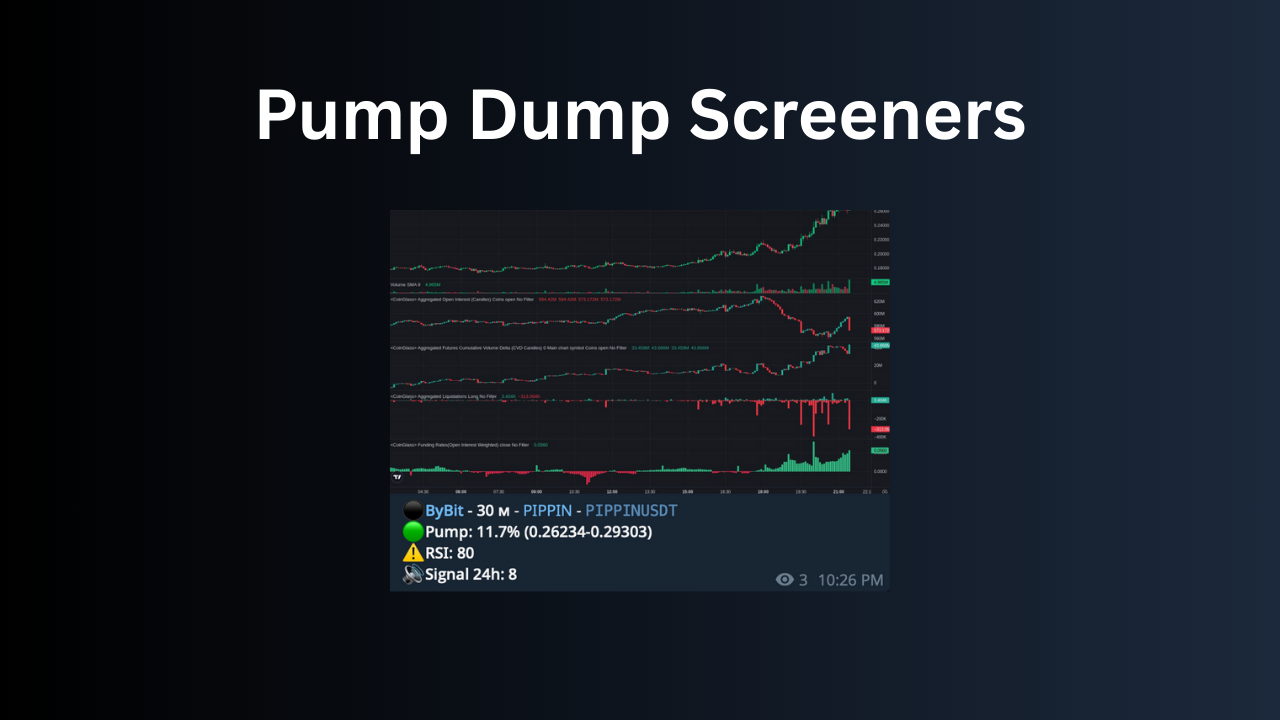

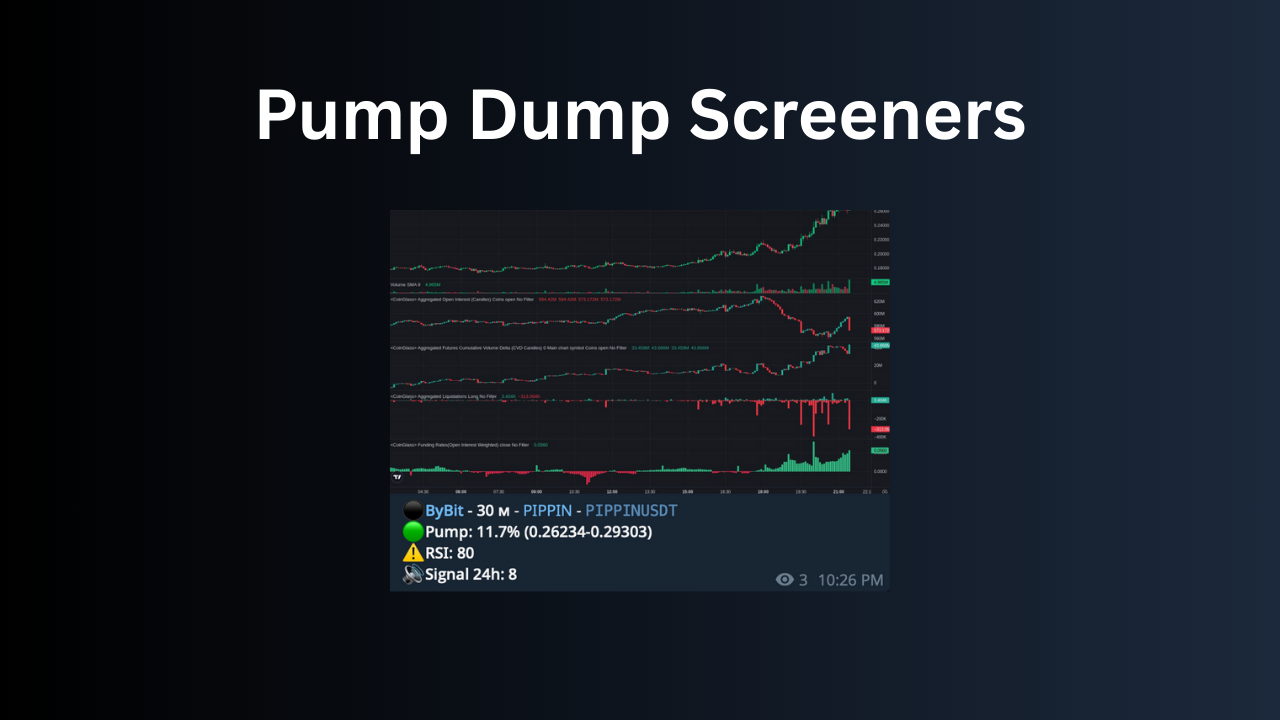

Pump Dump Screeners

A comprehensive system for monitoring market movements, liquidations, and open interest in real-time across 1000+ assets on Bybit, BingX, Binance, and MEXC.

A comprehensive system for monitoring market movements, liquidations, and open interest in real-time across 1000+ assets on Bybit, BingX, Binance, and MEXC.

The client needed a system for monitoring market movements, liquidations, and open interest in real-time across a wide range of instruments. Existing screeners lacked the necessary speed, data depth, stability, and filter customization for user trading strategies.

Additionally, a scalable solution was required because the client planned to sell subscriptions to the service and expected a significant number of users. The system had to simultaneously monitor 1000+ assets on Bybit, BingX, Binance, and MEXC with high reliability.

I developed a comprehensive screener ecosystem that collects, processes, and analyzes exchange data in real-time using asynchronous WebSocket streams with backup REST requests. The architecture ensures high-load handling and stability for a large user base.

The ecosystem includes specialized modules:

Signals are delivered via a flexible filtering system with Telegram integration, allowing each user to customize their notification settings.

Technical highlights:

A fully autonomous, commercially used screener ecosystem was created, monetized by the client via a Django admin panel. Currently, there are 200+ active users, and the service operates without downtime, delivering reliable signals 24/7.

The solution helps traders:

The system is scalable, does not rely on paid third-party APIs, and provides the client with a reliable foundation for further growth and subscriber increase.

Interface screenshots.

Write to me on Telegram or submit a request through the form on the main page.